A couple of weeks ago, I spent the day on campus at Western Washington University sitting on the Professional Advisory Council for the journalism department. I was honored to participate considering many of the people sitting in the room were the same who prepared me for the career track that I enjoy today.

A couple of weeks ago, I spent the day on campus at Western Washington University sitting on the Professional Advisory Council for the journalism department. I was honored to participate considering many of the people sitting in the room were the same who prepared me for the career track that I enjoy today.

We talked about curriculum and the demand for skills in the professional world. We talked about budget cuts. We talked about the value of education relative to the state of journalism.

We didn't talk about the bottom-line return on investment for a journalism degree. That's difficult to measure without extensive surveying and the forum wasn't appropriate, but I have to admit I've been thinking lately about the value of any higher education degree.

It's no shock that college is more and more radically expensive year after year. Due to rising costs, student loans are rising in parallel. A USA Today article reports:

The amount of student loans taken out last year crossed the $100 billion mark for the first time and total loans outstanding will exceed $1 trillion for the first time this year. Americans now owe more on student loans than on credit cards, reports the Federal Reserve Bank of New York, the U.S. Department of Education and private sources.

A Huffington Post columnist smartly put the student loan crisis in context to home loans: "An 18-year-old with no credit history and no job walks into a bank and requests a loan to buy a $100,000 condo. What is the loan officer most likely to say?" Obviously, the 18-year-old never gets the home loan but always gets the student loan. That's incredibly inconsistent and doesn't set up those taking student loans to be in any financial position to get a home loan for years to come, even with a down real estate market.

Of course, students are taking the money handed to them. You can't blame a young person for taking a multi-year financial vacation when given the choice. Who doesn't love a vacation? Heck, I try to take two a year myself!

The financial vacations don't end after four (or five or six) years either. In this economy where jobs are more difficult to find, graduates have two immediate choices: Take on at least two unpaid internships to build work experience, or go to graduate school -- building more debt.

Due to the loan environment, many people have pursued higher education, but because of the economy the U.S. now has a saturated market of M.A.'s, M.C.'s and even M.B.A.'s., making those degrees less valuable. Oh, and they have those student loans to start paying off at hundreds of dollars a month. I'm paying $400 a month on student loans from graduate school, which greatly impacts why we're a single-car household.

This all brings me back to the original point: We're in an education bubble.

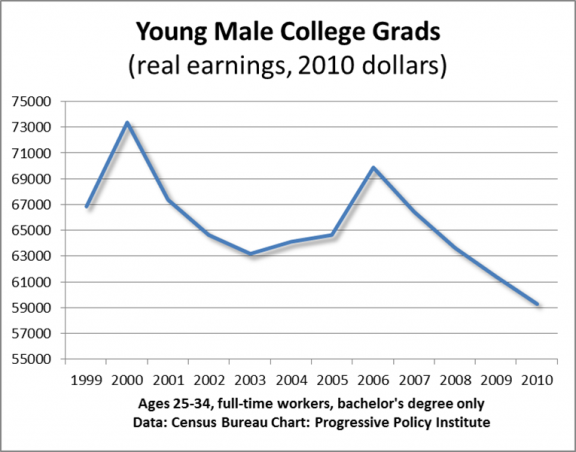

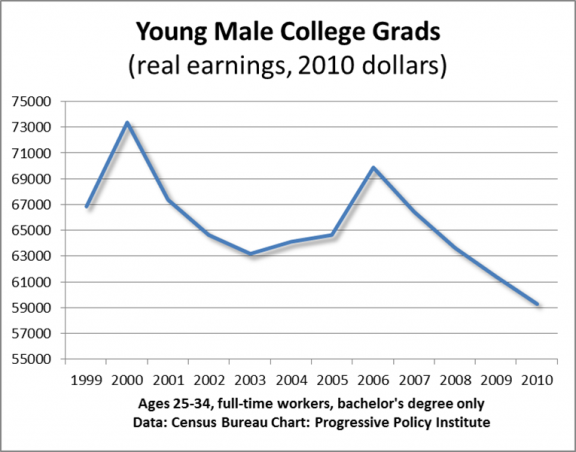

Graduates' wages are falling while the price of education skyrockets. Take a look at the UW's "Ten Year History of Tuition and Mandatory Fees" and compare that to the graph above.

At peak, graduates were earning $73,000 in 2010 when UW in-state undergraduate tuition and fees costs were about $3,800. That's a reasonable ratio of earning potential versus student loan potential. In 2010, graduates were earning $59,000 while tuition and fees costs jumped to $8,700. Over a 10-year period, earnings dropped 20% while tuition rose 228%. Yikes.

Those trends position education for a shitty ROI. Keep in mind, the pre-med students are better positioned than comm students to dig themselves out of this hole, ceretis paribus.

But all things aren't equal. Education -- the great class-leveler -- continues to be a class-divider as tuition prices move higher and out of reach of even progressive lower classes. Those who take on loans to access higher education are held by the anchors of debt accrued. Yes, a fraction of motivated, qualified students take advantage of scholarships, but what happens when fewer scholarships are available because the endowments don't scale with the rise of tuition?

Things can change. In a recent GOP presidential debate, Newt Gingrich cited the College of the Ozarks, which has an innovative-yet-obvious tuition solution that sets a path for its graduates to graduate debt-free. According to Wikipedia, "The College charges no tuition for full-time students, due to its student work program and donations. The program requires students to work 15 hours a week at an on-campus work station and two 40-hour work weeks during breaks. A summer work program is available to cover room and board costs." You work while you study. You're immediately accountable for the debt you incur and have opportunity to eliminate it. What a concept, huh?

That's really the best model I've heard for getting higher education costs under control, but is it realistic? Systematically changing the cost structure would need a culture-shift that I'm not sure anyone's ready for or wants. Unfortunately, that's the reason this is called an education "bubble." Nothing is going to happen and the bubble is going to pop.

A few days after my meeting at WWU, I saw a tweet from an acquaintance and former journalist that said: " [My] Son says he's taking 2 courses in journalism, my old job, at WWU next semester; torn between excitement or trying to talk him out of it."

I can't blame his reaction, especially as a former journalist forced out of the profession by technology advancements and market declines. Journalism doesn't exactly sound like a recipe for success. As a career track, it's not.

I consider journalism today a skill set expressed in many different forms. The journalism department at WWU is no longer a trade school but provides a curriculum of marketable skills -- researching and reporting. That's not an exclusive dynamic for journalism but for all degrees. They're providing skill sets, not job training. And it's not about getting the degrees, it's what you do with the skills acquired to get a job.

Expectations for education need to change with the times, as Occupy Wall Street demonstrates.

College costs will continue to be in crisis due to politics. Student loans aren't going away; we're not getting a bailout. However, people will have the choice in the future, as they have in the past, to take loans and enter higher education with a renewed expectation for what they earn -- networks, sharpened minds, maturity and verification of that experience by degree. No more, no less.

In a sense, we're back to an Old America economy, where only the pursuit of happiness is guaranteed. Only those who work hard -- by entrepreneurship, invention, education or trade -- will earn success. Education will be one path in the pursuit, and I expect that if we stay on this track, it will be a path less traveled.